Nj Sales Tax 2024. The state sales tax rate in new jersey is 6.625%, but you can customize this table as needed to reflect your applicable local sales tax rate. Quarterly sales and use tax returns are due.

The amount of sales tax you’ll owe is calculated by. The base level state sales tax rate in the state of new jersey is 6.63%.

Sales And Use Tax Online Filing And Payments.

Those costs are passed on to the buyer,.

2024 State Tax Expenditures Report | Njoit Open Data Center.

(by zip code qty) full list of nj cities.

Average Sales Tax (With Local):

Images References :

Source: zamp.com

Source: zamp.com

Ultimate New Jersey Sales Tax Guide Zamp, Nj quarterly sales tax due dates 2024. Every 2024 combined rates mentioned above.

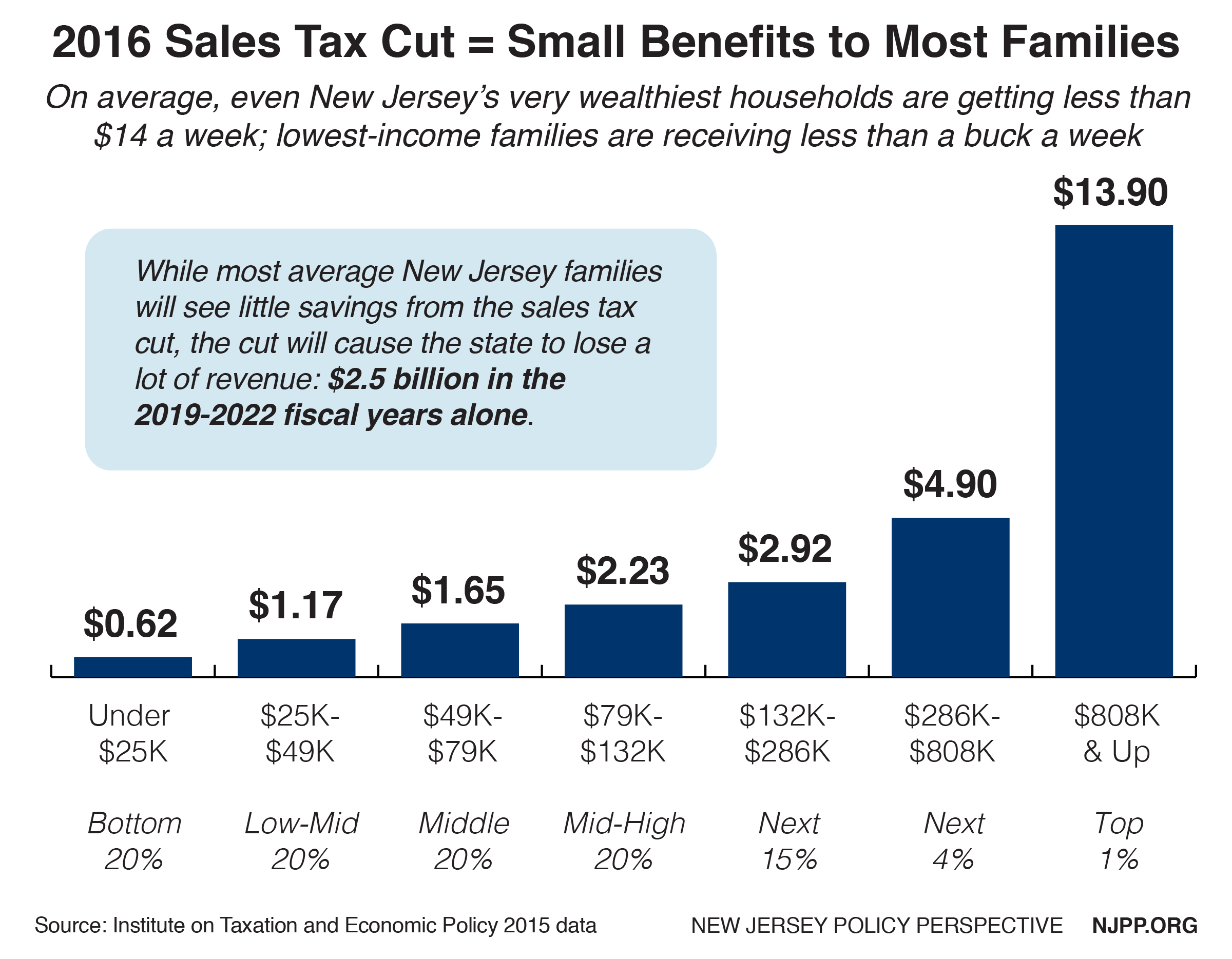

Source: www.njpp.org

Source: www.njpp.org

Modernizing New Jersey’s Sales Tax Will Level the Playing Field and, Over the next three years, new jersey will phase out a sales tax waiver for people buying new and used. New jersey sales tax rates & calculations in 2023.

.png) Source: taxfoundation.org

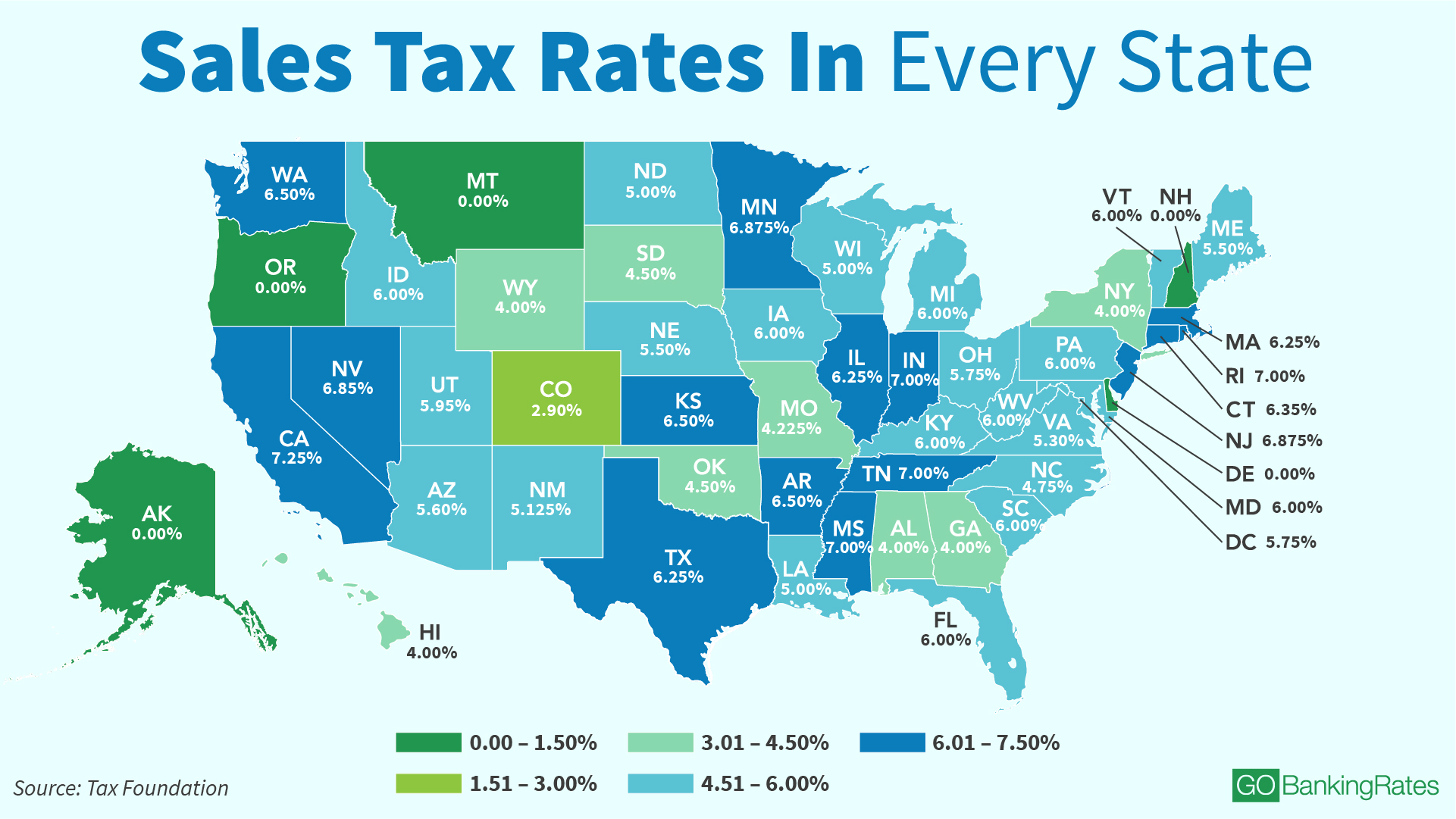

Source: taxfoundation.org

Monday Map Combined State and Local Sales Tax Rates, Quarterly sales and use tax returns are due. 2024 new jersey state sales tax.

Source: old.sermitsiaq.ag

Source: old.sermitsiaq.ag

Printable Sales Tax Chart, This bulletin has been designed as a guide to new jersey sales tax and the taxability of. New jersey has a 6.625% statewide sales tax rate , but also has 310 local tax jurisdictions (including cities, towns, counties, and special districts) that collect an average local sales.

Source: taxfoundation.org

Source: taxfoundation.org

How High Are Sales Taxes in Your State? Tax Foundation, 506 lots featured in annual spring | april 2024 | day 2 of 2 on apr 20, 2024 by bertoia auctions in nj, featuring horse race mechanical bank, boxed ives. Those costs are passed on to the buyer,.

Source: justonelap.com

Source: justonelap.com

Tax rates for the 2024 year of assessment Just One Lap, Payment dates for weekly payers. 2024 guide to state sales tax in new jersey.

Source: www.gobankingrates.com

Source: www.gobankingrates.com

Sales Tax by State Here's How Much You're Really Paying GOBankingRates, List of local sales tax rates. New jersey sales tax range for 2024.

Source: wisevoter.com

Source: wisevoter.com

Sales Tax by State 2023 Wisevoter, Lowest sales tax (6.625%) highest sales tax (8.625%) new jersey sales tax: (by zip code qty) full list of nj cities.

Source: blog.accountingprose.com

Source: blog.accountingprose.com

New Jersey Sales Tax Guide, Quarterly sales and use tax returns are due before 11:59 p.m. New jersey sales tax guide.

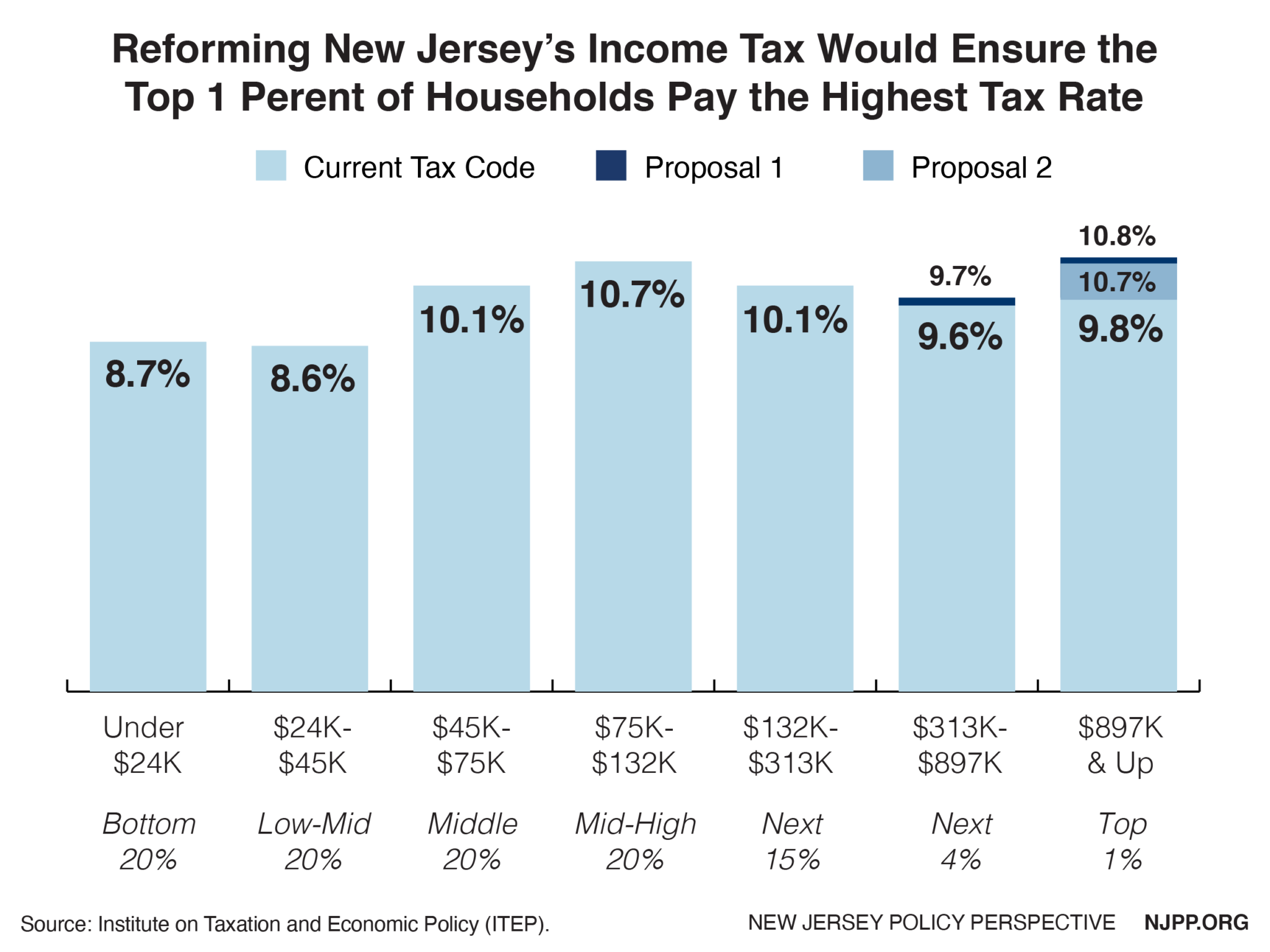

Source: www.njpp.org

Source: www.njpp.org

Road to Recovery Reforming New Jersey’s Tax Code New Jersey, New jersey has a 6.625% statewide sales tax rate , but also has 310 local tax jurisdictions (including cities, towns, counties, and special districts) that collect an average local sales. 6.625% base state sales tax rate.

New Jersey Assesses A 6.625% Sales Tax On Sales Of Most Tangible Personal Property, Specified Digital Products, And Certain Services Unless Specifically Exempt Under New Jersey Law.

Of the 20th day of the month after the end of the filing.

The New Jersey State Sales Tax Rate Is 7%, And The Average Nj Sales Tax After Local Surtaxes Is.

The amount of sales tax you’ll owe is calculated by.